SEARCH THE BEST PROPERTIES

All over the world

For Sellers

Our international reach will help you get the highest price for your property, with the fewest hassles, in the shortest amount of time.

For Buyers

Search our database of properties and create alerts for yourself. You’ll be the first to know when a property that matches your search criteria hits the market.

For Agents

Gain exposure to a global audience through our website. Your marketing will reach those most likely to become buyer and seller clients.

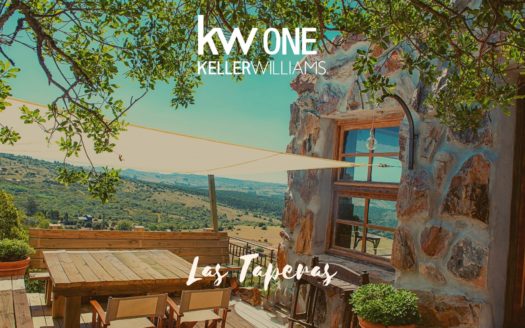

Some of our favorite listings

Apartments

Houses

Villas

Land

Hotel